The Chronicles Of Grant County

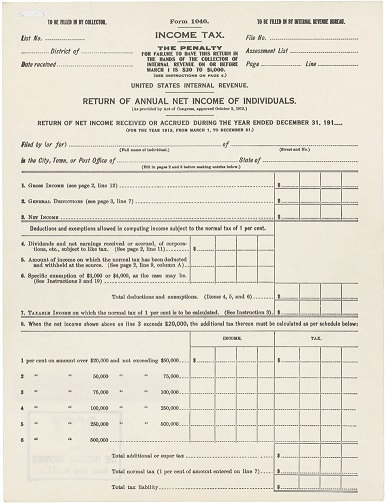

This is what the first Form 1040 looked like in 1913. (The image was provided courtesy of the National Archives.)

This is what the first Form 1040 looked like in 1913. (The image was provided courtesy of the National Archives.)

Residents of Grant County have officials in Santa Fe (as well as Dover and Cheyenne) to thank for having to pay the Federal income tax.

Today is the anniversary of the decision of the New Mexico State Legislature to approve the 16th Amendment to the United States Constitution. That decision in Santa Fe occurred on the same day as similar votes by legislatures in the state capitals of Delaware and Wyoming on February 3, 1913.

According to the United States House of Representatives, the road to passage of the 16th Amendment among the states began “after a brisk debate on July 12, 1909, lasting for five hours” in the House of Representatives. Following that debate, “the bill passed 318–14, with 1 voting ‘present,’ and 55 not voting.”

The first Form 1040 (yes, they called it a “1040” even in 1913) noted that the “normal tax [rate] of 1%” was to be paid on taxable income by March 1st of the following year.

The 1% tax rate was assessed on taxable income (gross income minus certain deductions and exemptions) up to $20,000.00.

While few deductions and exemptions were allowed in 1913, the ones that were provided removed most Americans from having to pay any Federal income tax.

If you were single and had income less than $3,000.00, you did not pay any Federal income taxes. According to the United States Bureau of Labor Statistics, that amount in March of 1913 would have equated to $78,665.51 in December of 2019.

If you were married and had income less than $4,000.00, you also did not pay any Federal income taxes. The Bureau of Labor Statistics indicated that amount in March of 1913 would have equated to $104,887.35 in December of 2019.

“…In 1913, due to generous exemptions and deductions, less than 1 percent of the population paid income taxes at the rate of only 1 percent of net income,” according to the National Archives.

In addition to the “normal tax,” there was an “additional or super tax” on taxable incomes greater than $20,000.00.

If you had taxable income of at least $20,000.00, but no more than $50,000.00, you paid an additional 1% in Federal income taxes. A 2% additional tax was assessed on taxable income between $50,001.00 and $75,000.00; a 3% additional tax was assessed on taxable income between $75,001.00 and $100,000.00; a 4% additional tax was assessed on taxable income between $100,001.00 and $250,000.00; a 5% additional tax was assessed on taxable income between $250,001.00 and $500,000.00; and a 6% additional tax was assessed on taxable income greater than $500,000.00.

To put these numbers into perspective, the Bureau of Labor Statistics indicated that

$20,000.00 in March of 1913 would equate to $524,436.73 in December of 2019; $500,000.00 in March of 1913 would equate to $13,110,918.37 in December of 2019.

The highest Federal income tax rate was 7% in 1913.

The highest Federal income tax rate was 37% in 2019. (Of course, there are a wide variety of deductions, exemptions, and other items in today’s tax code. And the Federal income tax is only one of the federally-mandated taxes based on income.)

Today, the majority of American individuals and families pay Federal income tax.

Be glad it’s not 1944 or 1945.

In those years, the highest marginal tax rate for Federal income taxes was 94%.

Yes, 94%.

While the “normal tax rate” was 3%, surtaxes were applied to net incomes greater than $5,000.00. The surtaxes, according to a news article dated January 9, 1945, in The Pantagraph of Bloomington, Illinois, began at 20% for the first additional $2,000.00 in net income (beyond $5,000.00) and gradually rose to “91 percent on [net income in] excess…[of] $200,000.00.”

Please note that $5,000.00 in March of 1944 equated to $73,843.10 in December of 2019, according to the Bureau of Labor Statistics; $200,000.00 in March of 1944 equated to $2,953,724.14 in December of 2019.

The Federal income tax has come a long way from the time when less than 1% of Americans paid a “normal tax” of 1% and a small number of Americans paid an “additional or super tax” of up to 6% extra on net income in 1913.

The headquarters of the United States Internal Revenue Service as seen in 1991. (The photo was provided courtesy of the Library of Congress.)

The headquarters of the United States Internal Revenue Service as seen in 1991. (The photo was provided courtesy of the Library of Congress.)

Do you have questions about communities in Grant County?

A street name? A building?

Your questions may be used in a future news column.

Contact Richard McDonough at chroniclesofgrantcounty@gmail.com.

© 2020 Richard McDonough