By Paul Gessing

Nearly any business owner in New Mexico will tell you that Michelle Lujan Grisham and her policies have been unfriendly to business. Setting aside the COVID lockdowns, since she took office in 2019, we’ve seen multiple tax hikes, numerous new regulations, and numerous policies that make it more costly and difficult to hire workers.

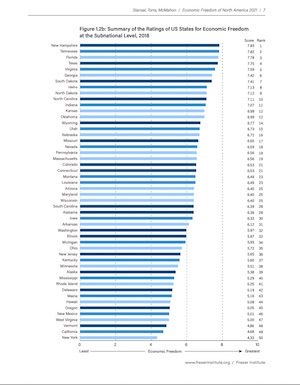

These policies aren’t just “anti-business,” taken as a whole they undermine economic freedom. A new study provides hard data that quantifies and highlights the negative impact of policies of Lujan Grisham and the Legislature (at least in 2019).

For starters, it is worth defining the term. Economic freedom is broadly speaking the ability to engage in voluntary economic transactions without unduly being hindered by government policies. This includes low, fair taxation, reasonable rules and regulations, and a limited government spending.

Not surprisingly, policies of economic freedom are strongly correlated with greater economic prosperity. In fact, according to the 2021 edition of the report, the freest 25% of states have personal incomes that are 7.5% higher than the national average while the 25% of least free states have personal incomes that are 1% less than the national average.

New Mexico has long lagged its neighbors and most of the nation in economic freedom having consistently been in the lowest quartile for years. Thus, it is not surprising that New Mexico is among the most impoverished states in the nation.

But, when Gov. Susana Martinez took office in 2011, New Mexico ranked 46th in economic freedom. Despite her having to deal with a hostile Legislature, that number improved to 42nd by the last year of her administration mostly due to her fiscal restraint.

But, when Gov. Susana Martinez took office in 2011, New Mexico ranked 46th in economic freedom. Despite her having to deal with a hostile Legislature, that number improved to 42nd by the last year of her administration mostly due to her fiscal restraint.

But, when Lujan Grisham took over in 2019 along with a liberal Legislature the State saw a massive uptick in government spending, several tax hikes, new regulations, and numerous other policies that make New Mexico less economically-free. On the other hand, New Mexico’s neighbors are all among the most economically-free states in the nation. Texas, with no personal income tax and a pro-freedom labor laws like “Right to Work” ranks 4th overall.

While we don’t have the data on how economic freedom has fared in New Mexico in 2020 and 2021, we know that in general Gov. Lujan Grisham and the Legislature seem to look to California as their model. Alas, the State is one of the few ranked worse than New Mexico on economic freedom at 49th. Only New York performs worse.

The fact is that the policies passed in 2019 that caused New Mexico to slide in economic freedom have only been reinforced by others that further undermine economic freedom in 2020 and 2021.

With a $2 billion surplus, Gov. Lujan Grisham has proposed a miniscule reduction in the gross receipts tax (while leaving the grotesque pyramiding and loopholes intact). But, we can expect that an overwhelming majority of that surplus will go to even more government spending that will do nothing to actually improve New Mexico’s serious poverty challenges or overall economic outcomes.

It is time for New Mexico politicians (and voters) to prioritize economic freedom in turning our State around.

Paul Gessing is president of New Mexico’s Rio Grande Foundation. The Rio Grande Foundation is an independent, nonpartisan, tax-exempt research and educational organization dedicated to promoting prosperity for New Mexico based on principles of limited government, economic freedom and individual responsibility